Skip-a-Pay

Skip-a-Pay

We know you work hard, and you deserve loan programs that work hard for you. Welcome to our Skip-A-Payment program! As a Zeal member, you can skip two loan payments per year.* You have control over which loan payments you skip, and when you skip them.

How does it work?

To skip a loan payment, follow these steps: (For a step-by-step video tutorial click here.)

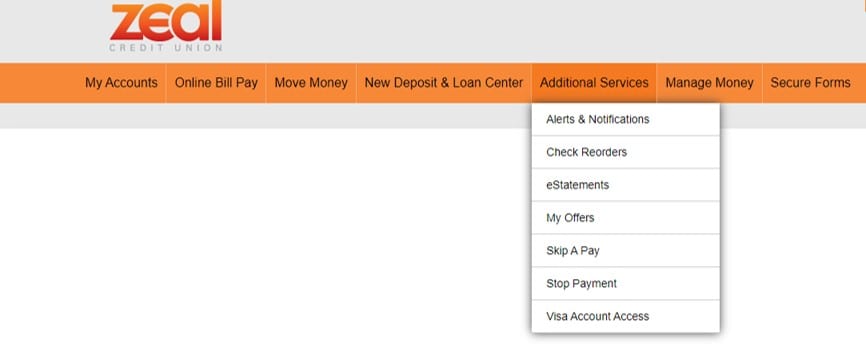

- Log in to Online Banking and click the “Additional Services” tab to access the Skip-a-Pay feature.

- Once you access your Skip-A-Pay page, simply follow the instructions on the screen to complete your request.

a. Your Skip-A-Pay page will list all of your loans, as well as any notes regarding the eligibility of the loan.

b. You will be allowed to skip any two non-consecutive payments per year for qualified loans!*

c. Please note that there is a $25 service fee per skipped loan payment.

d. If you don’t have Online Banking, you may enroll for the service by clicking here, or visit a branch to take advantage of the Skip-A-Pay feature.

Skip-a-Pay Qualifications

*To skip-a-pay, you must have made 4 (four) consecutive contractual payments from the contract date. Your loan can not be more than 9 days late. Your loan can not be paid ahead more than 60 days. The request must be received 4 (four) business days before your payment is due for those accounts with scheduled transfers. Payment must be greater than $30. You cannot skip more than two payments per year. You can not skip consecutive payments on the loan. Account must be in good standing and cannot have any charged off accounts (deposits or loans). The following loans do not qualify for the skip a pay program: Visa, First Mortgages, Home Equity Interest Only loans and Payday loans. All other loans are eligible.

Other important information: This offer is subject to final approval of Zeal Credit Union. If the loan is held jointly, all owners must agree. If your loan payment is made via ACH or Automatic Transfer, the total monthly payment amount will not be credited to your loan account for the month you elected to skip. Finance charges will continue to accrue daily at the Annual Percentage Rate set forth in the loan agreement, both during and after the deferral period. This means it will result in higher total finance charges and possibly a higher total number of payments, than if made as originally scheduled. Therefore, extra payment(s) may/will have to be made after the loan would otherwise have been paid off. In all other respects, the provisions of the original agreement remain in full form and effect. Regularly scheduled payments will resume with the payment due during the month following the deferral. This may/will affect GAP coverage on your loan.